Address

8-9 Marino Mart, Fairview, Dublin 3, D03 EK81, Ireland

Contact

[email protected]£49.00

The Power BI Accounts Receivable template from Accounting Insights is for finance and collections professionals that want to drive down average debtor days.

Unlike conventional aged debtor reports, this Power BI Accounts Receivable template is highly interactive. Across just three report pages, it provides the following insights:

The Receivables Overview page (called “Receivables”) of the Power BI Accounts Receivable Template gives a company-wide overview of your debtors.

The Receivables Overview page of the Accounts Receivable Template for Power BI tracks the following 10 Accounts Receivable KPIs for the whole company and any selected customers:

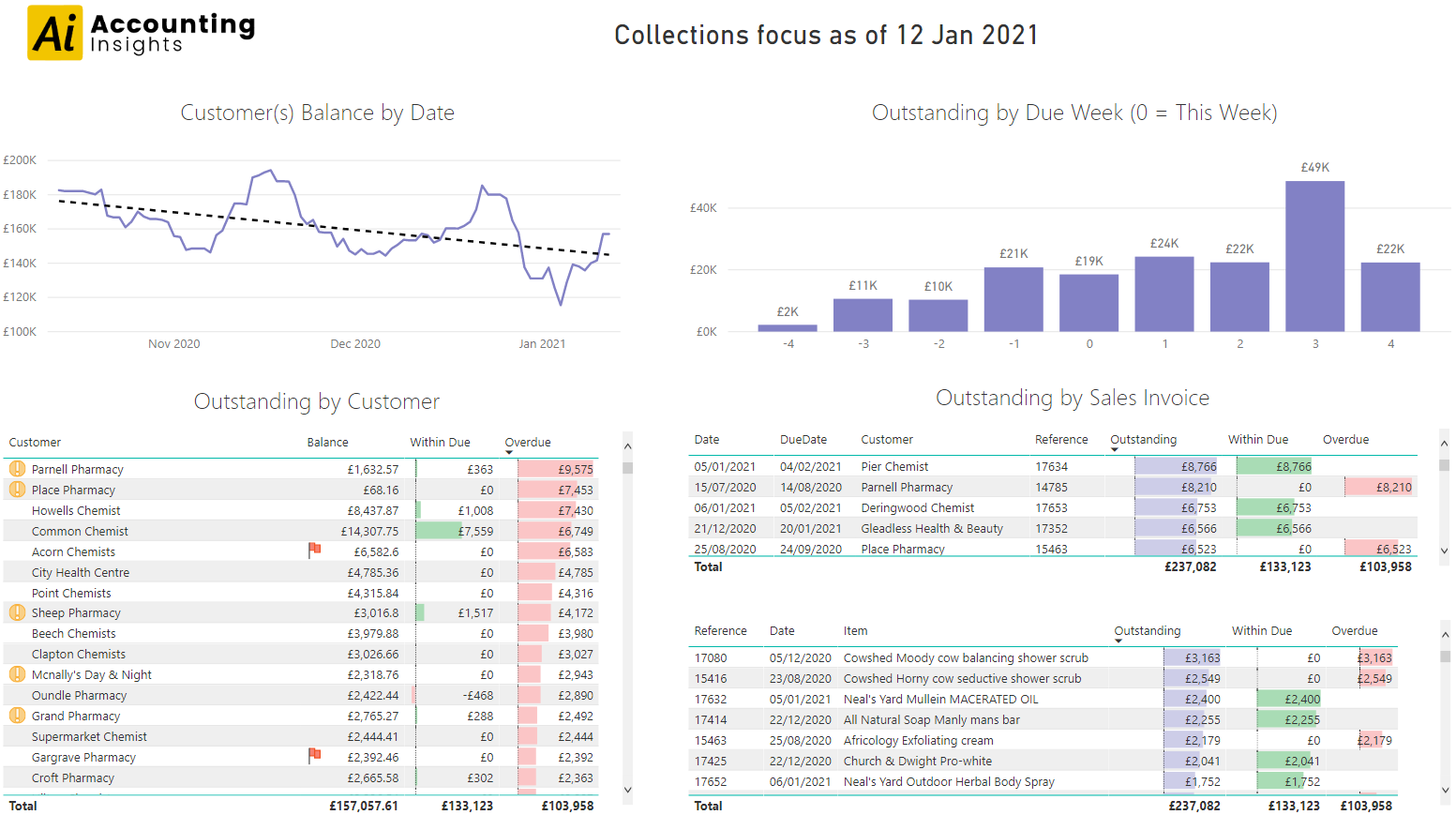

The Collections page presents a more detailed picture of your Accounts Receivable, showing a timeline of receivables falling due by customer, invoice and invoice item with the customer(s) balance history.

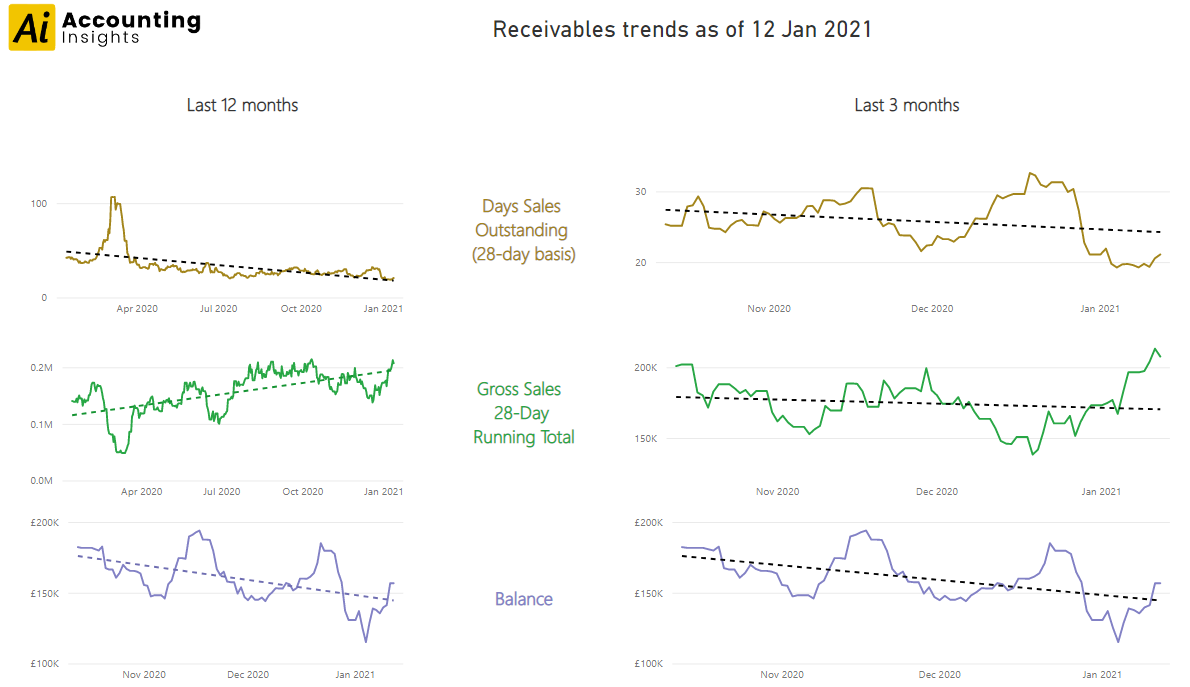

The trends page of the Accounts Receivable template shows the underlying trends of the receivables over the last 12 months and three months. Three trends are tracked:

| Template | PowerBI & Sage50 Accounts |

|---|